A House Is an Emotional Investment, Not a Financial One

How a 1950s government-bank partnership created the American Dream

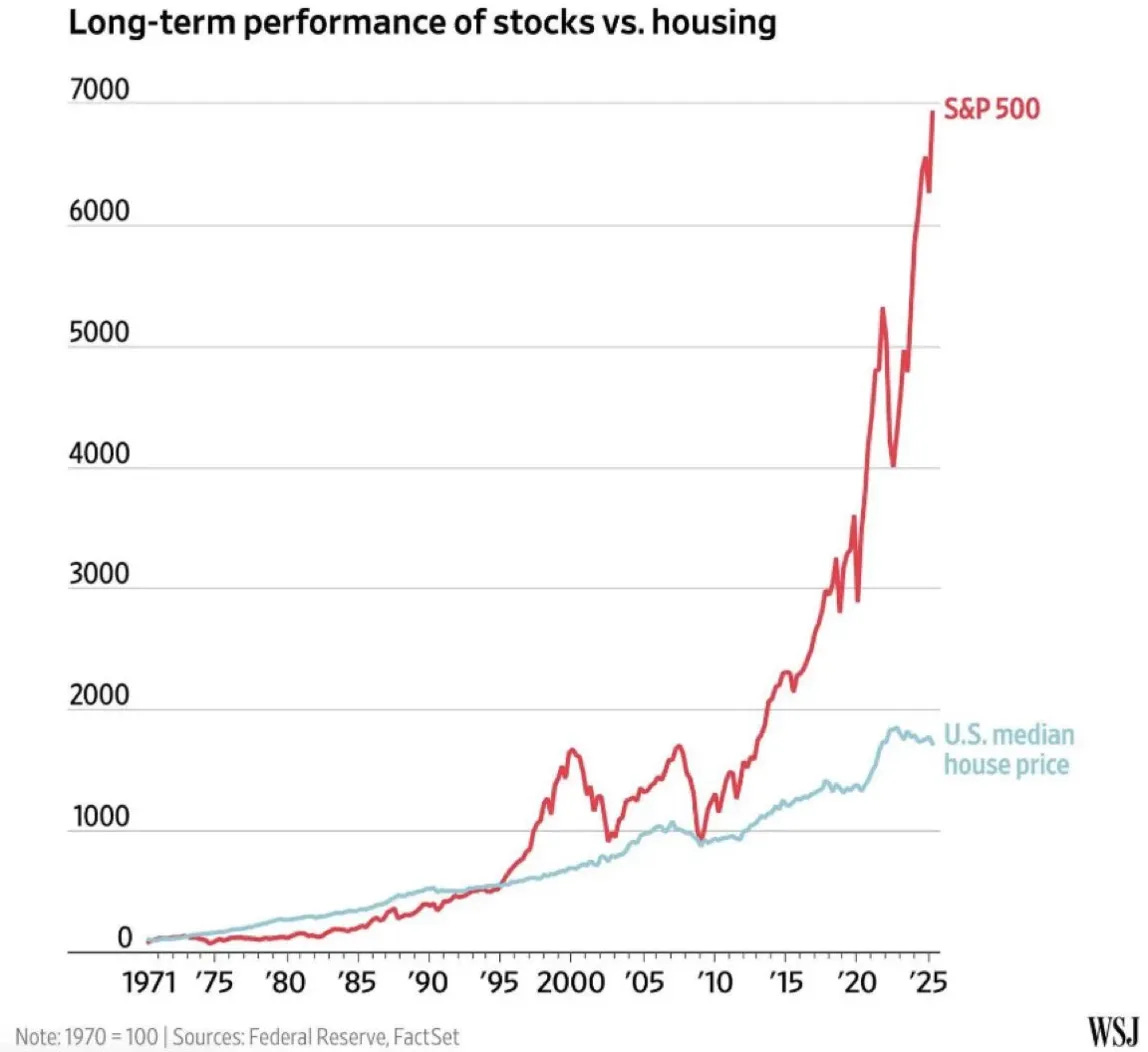

This graph has been going viral online. Since 1970, the S&P 500 has vastly outperformed housing. But let’s break down what this actually means in dollar terms.

The 20-Year Reality Check

Let’s compare two scenarios over 20 years (2005-2025) using the chart data.

Scenario 1: Buy a $500,000 house with $50,000 down and a 4% interest loan. After 20 years of paying dead costs (interest, property taxes, maintenance, insurance) that don’t build equity, the house sells for $1,050,000 based on the chart’s 2.1x housing appreciation. Net gain (profit) after subtracting 20 years of dead costs and building some equity? $177,000.

Scenario 2: Rent and invest that $50,000 in the S&P 500 instead. Rent a similar home for a lower monthly cost and invest the extra monthly cash in the market. Based on the chart’s 5.8x S&P growth, the portfolio after 20 years? $840,000.

You’d have 4.7x more wealth—and it’s completely liquid.

(For detailed math breakdown, see Appendix below)

So why do we believe homes are investments?

How We Got Here

In the 1950s, banks and insurance companies had massive cash reserves sitting idle. They needed borrowers. But nobody wanted 30 years of debt.

So they made a deal with the government.

The pitch: “Help us create demand for mortgages(debt). Make homeownership patriotic. Make it the American Dream.”

The government’s incentive: Post-WWII economic recovery. Get soldiers into homes. Stabilize the economy.

The banks’ demand: “We’ll lend—but only if you guarantee it.”

The government agreed. FHA (Federal Housing Administration) backing made mortgages risk-free for lenders. Banks couldn’t lose.

Life insurance companies like Prudential tripled their real estate investments post-war. Suburban developments became profit machines—high returns, zero risk, government-backed.

The result: A propaganda machine telling Americans that owning a home equals success. Banks won. The government got economic growth. Homeowners got debt.

Why Prices Kept Rising

Post-2008, the government doubled down. They subsidized DEMAND—not SUPPLY.

Homebuyer assistance programs, low interest rates, printed money flowing to buyers. But builders didn’t proportionally increase construction.

What happens? More money chasing the same number of houses. Prices skyrocket.

Think of luxury watches. Rolex doesn’t make more when demand increases. Prices just rise because supply stays constrained.

Housing worked the same way. Government money inflated prices artificially.

Why It’s About to Collapse

Three forces are colliding:

Demographics: Birth rates falling. Boomers own ~60% of homes. As they die, kids inherit and want cash, not houses. So a mass selling of homes is coming.

Policy Reversal: New federal government policy is pushing the cutting of subsidized demand while deregulating supply. Faster permitting, fewer restrictions.

AI Construction: Building is getting cheaper and faster. Supply surges while your locked capital sits idle in depreciating boxes.

Result: More homes. Fewer buyers. Less government money. Prices fall.

And while capital is trapped in single-family homes, AI-driven companies are optimizing margins, compounding profits, and creating wealth for shareholders who kept their cash in liquid assets. A liquid asset is one that can be quickly/easily sold when cash is desired

The exceptions?

Specific neighborhoods like Atherton, Beverly Hills, Malibu—places where zoning boards protect wealthy homeowners by blocking new supply.

Investment properties generating rental cash. This analysis focuses on primary residences—the house someone lives in and pays a mortgage on.

The Bottom Line

A single family home isn’t wealth. It’s debt masked as an asset.

The banks sold debt disguised as a dream. The government inflated the price to stimulate the economy. Both are reversing.

In an age where AI allows corporations to optimize, compound, and capture profits at unprecedented scale, capital needs to be where the growth is—in businesses, not boxes.

The companies leveraging AI are creating wealth. Homeowners are watching equity evaporate while cash sits locked in 30-year debt loops.

Unless it’s in one of few ZIP codes in the US that will restrict supply, a house is a depreciating consumer durable.

Finance is zero-sum, there is always one winner and one loser. When banks lend, they win. Who loses? The homebuyer.

Stay curious. Stay liquid. Have fun.

Appendix: The Detailed Math

Scenario 1: Buy the House

Purchase: $500,000 house, $50,000 down (10%), $450,000 mortgage at 4%

Monthly dead costs (interest at 4% + property tax, maintenance, and insurance at 1% each of purchase price): $2,450/month that doesn’t build equity

Over 20 years, these dead costs total $590,000.

During that time, you pay off ~$167,000 in principal (equity).

At sale (house appreciated 2.1x per chart):

Sale price: $1,050,000

Remaining mortgage: ~$283,000

Gross equity: $767,000

Minus dead costs: -$590,000

Net: $177,000

Scenario 2: Rent + Invest in S&P 500

Initial investment: $50,000 into S&P 500

Monthly: Rent for $2,500/month (vs. $3,400 homeownership costs). Invest the $900 difference.

After 20 years (S&P 5.8x per chart):

Initial $50,000 → $290,000

$900/month compounding → ~$550,000

Total: $840,000 (liquid)

Result: $840,000 vs. $177,000 = 4.7x more wealth by renting and investing